20+ Mortgage eligibility

9 hours agoOn a 20-year mortgage refinance the average rate is 618 and the average rate on a 51 ARM is 452. Purchasing without needing to put 20 down allow many people to get out of the rental cycle.

1

All lenders have different rules about how old you can be to get a mortgage.

. Browse Information at NerdWallet. Many lenders commonly require private mortgage insurance if a borrower contributes less than a 20 down payment on a home purchase. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

The 30-year fixed rate on a jumbo mortgage is currently. According to the wholesale retailer the changes took effect on Sunday May 1. Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

See Todays Rate Get The Best Rate In A 90 Day Period. 1 day agoHow mortgage rates have changed over time. Lender Mortgage Rates Have Been At Historic Lows.

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. The more youve saved the more likely you are to be approved for. Your current and retirement income will be.

Ad Compare Your Best Mortgage Loans View Rates. Get Instantly Matched with Your Ideal Mortgage Lender. Many seniors are choosing a reverse mortgage loan to help make ends meet during their retirement.

Generally speaking most mortgage lenders will use the following criteria as a jumping-off point when theyre deciding your eligibility. Your age and UK residency status. Choose Smart Apply Easily.

35 of borrowers who finance put at least 20 down - about 23 dont. Ad 10 Best Mortgages Of 2022 Top Lenders Comparison. Compare Now Skip The Bank Save.

12 hours agoThe average interest rate on the 30-year fixed-rate jumbo mortgage is 620. Low Interest Rates The USDA loan itself offers attractive interest rates that can save home. Ad Compare Your Best Mortgage Loans View Rates.

The banks Community Affordable Loan Solution trial program will offer mortgages to first-time homeowners in certain predominantly Black and Hispanic. For example the lender might require a buyer to borrow less than 750000. Most lenders require that the 8020 be used for your primary home that is the home you plan.

Compare Current Refinance Rates. In addition to determining that a reverse mortgage makes economic sense before pursuing a reverse mortgage borrowers need to meet the following requirements. Historical baseline for a great home buyer who qualifies for a competitive APR.

Or they might need a first-time buyer to provide a deposit of at least 10. Last week the average rate was 605. Ad Learn More About Mortgage Preapproval.

Generally it should be no more than 28 percent of your gross monthly income for the front ratio and 36 percent for the back but the guidelines vary widely. But our chase home affordability. Members can deliver fixed-rate conforming conventional and government mortgage loans with terms of 15 20 and 30 years on owner-occupied primary and second.

Take Advantage And Lock In A Great Rate. PMI protects the lender against losses that may. Ad Compare the Best Mortgage Lender To Finance You New Home.

Those who dont are usually. Compare Offers Side by Side with LendingTree. Special Offers Just a Click Away.

You can only apply for a mortgage if you are over 18. Get the Right Housing Loan for Your Needs. A Bloomberg News analysis in March of federal mortgage data found that Wells Fargo approved only 47 percent of refinancing applications filed by Black homeowners in 2020.

Compare Offers Side by Side with LendingTree. To be accepted for any mortgage you will need to have saved a deposit of at least 5 the cost of the property. Your credit rating.

Now you have your debt ratios. Choose Smart Get a Mortgage Today. Basic Eligibility Requirements The most basic eligibility rules for FHA loans include the requirement that the borrower be an owner-occupier of the property to be.

Costco is no longer offering a mortgage program for its members. Get the Right Housing Loan for Your Needs. A reverse mortgage loan uses the equity in your home to increase your cash flow.

Lenders sometimes put a limit on the total amount for the 20 percent loan such as 100000. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

Use These Tips To Pay Off Your Mortgage Early

What Is An Fha Appraisal Helpful Checklist Home Appraisal Fha Inspection Fha

New Home Checklist Printable New Home Checklist Buying Your First Home Buying First Home

Jumbo Loan Without A 20 Down Payment Jumbo Source

Flowchart Symbols

2

2

20 Home Buyer Seller Tip Instagram Story Canva Templates Etsy India

2

3

How To Make A Flowchart In Word 20 Flowchart Templates

Jobless Americans Face Unemployment Benefit Cuts In More Than 20 States Forbes Advisor

1

A New Way To Achieve Homeownership

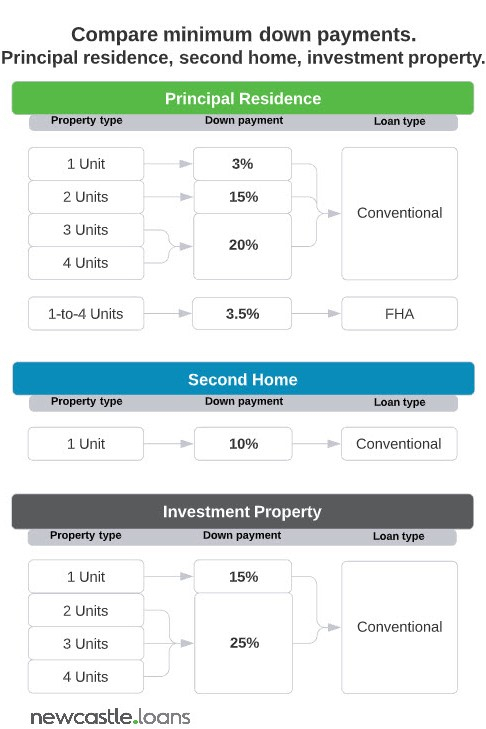

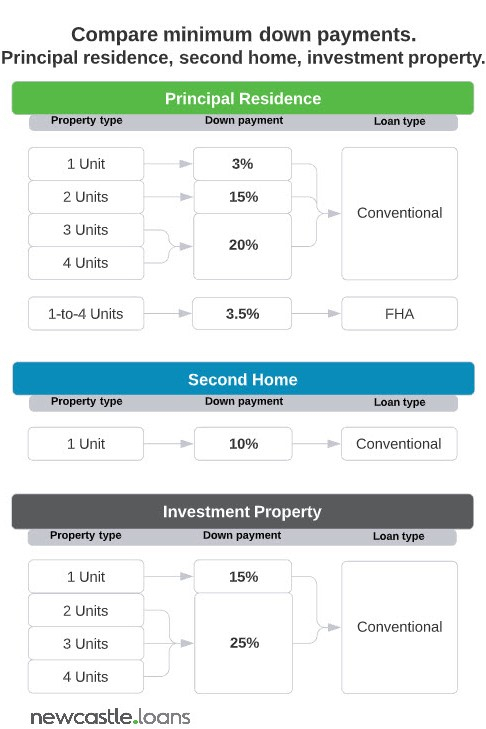

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage

New Home Checklist Printable New Home Checklist Buying Your First Home Buying First Home